Other videos

Honorary Lecture (Fulbright Chair) Prof. Tracy A. Kaye, December 16, 2024

<iframe height="270" width="500" src="https://planetestream.wu.ac.at/Embed.aspx?id=14086&code=bH~ovcKx5IsAHoa84yIE4HbE2wdPe" frameborder="0" allowfullscreen></iframe>

Klaus Vogel Lecture 2024

<iframe height="270" width="500" src="https://planetestream.wu.ac.at/Embed.aspx?id=12835&code=ci~efGJFMrIO3MEf4BXbaVXeCBTBY" frameborder="0" allowfullscreen></iframe>

Inaugural Lecture Univ.- Prof. Dr. Karoline Spies, Januray 24, 2024

<iframe height="270" width="500" src="https://planetestream.wu.ac.at/Embed.aspx?id=9309&code=bY~iac5qLoFjhgwEU9JJEVBeLKMyF" frameborder="0" allowfullscreen></iframe>

Guest Lecture Prof. Dr. Eivind Furuseth, December 4, 2023

Guest Lecture Prof. Furuseth

The Guest Lecture of Prof. Dr. Eivind Furuseth (Norwegian Business School BI), on the topic: “The Use of Tax Incentives to Promote the Change to a Green Economy”, took place on December 4, 2023.

Klaus Vogel Lecture 2023

<iframe height="270" width="500" src="https://planetestream.wu.ac.at/Embed.aspx?id=7899&code=bl~PwFFd37qEec6fKwKSVBgt7mY" frameborder="0" allowfullscreen></iframe>

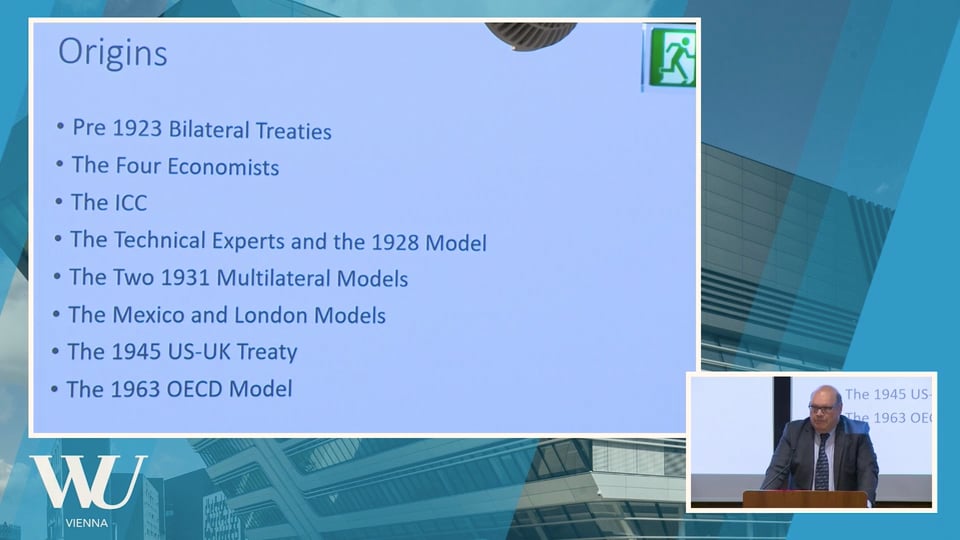

Honorary Lecture (Fulbright Chair) Prof. Reuven Avi-Yonah, April 27, 2023

honorary_lecture_von_prof._reuven…

The Honorary Lecture (Fulbright Chair) of Prof. Reuven Avi-Yonah (University of Michigan Law School), on the topic: "A Multilateral Tax Treaty: Historical Origins and Future Prospects", took place on April 27, 2023

Klaus Vogel Lecture 2022

Klaus Vogel Lecture 2022 mit…

Inaugural Lecture of the WU Tax Law Technology Center

Inaugural Lecture TLTC, January…

The Inaugural Lecture of the WU Tax Law Technology Center, on the topic: “The transformation of tax & customs law into the digital world of processes, automation and predictions“, took place on January 19, 2022.

Inaugural Lecture Prof. Georg Kofler

Video - Inaugural Lecture Prof.…

Inaugural Lecture Prof. DDr. Georg…

The Inaugural Lecture of Prof. DDr. Georg Kofler, Professor at WU, on the topic: “Gimme Shelter”: The Shielding Effect of European Tax Directives, took place on November 15, 2021.

Klaus Vogel Lecture 2021

Klaus Vogel Lecture 2021

Klaus Vogel Lecture 2020

Klaus Vogel Lecture 2020

Inaugural Lecture Prof. Walter Hellerstein

Inaugural Lecture: Prof. Walter…

Addressing the Direct and Indirect…

The Inaugural Lecture of Prof. Dr. Walter Hellerstein, Visiting Professor at WU, to the topic: "Addressing the Direct and Indirect Tax Challenges of the Digital Economy: Reflections of a US State Tax Lawyer on Recent International and Subnational Developments" took place on November 21, 2019.

Klaus Vogel Lecture 2019

Klaus Vogel Lecture 2019

EUCOTAX Wintercourse 2016

The EUCOTAX Wintercourse is a seminar in International Tax Law which takes place each year. The subject area is 'The European Harmonization of Tax Law' and each year a different theme is explored and studied.

The 'Potential Impact of BEPS on Tax Systems' was the topic for the EUCOTAX Wintercourse 2016, held at WU Vienna and hosted by the Institute for Austrian and International Tax Law, WU.

In this program both students and researchers contribute. Therefore, this program provides both an intensive instructional part as a joint scientific publication by the researchers.

The first Wintercourse was held in Tilburg, the Netherlands in 1993 by the universities of Hamburg, Paris and Tilburg. Vienna joined the EUCOTAX-network during the 1998-course. Because of the program's success, the number of participating universities has been extended to now being 15 Universities. Ultimately, the participants' intention is to cover the entire European Union which needs a gradual extension of the number of participating countries.

For further information about the EUCOTAX-Programme click here...

BEPS - Thought Leadership

Vogel Online Updates

Workshop on Taxpayers' rights by Nina Olson

Inaugural Lecture from Prof. Alexander Rust

Alexander Rust was appointed Full Professor for International Tax Law at the WU as of 1 June 2014. He previously worked as professor at the University of Luxembourg where he also set up a master program in European and International Tax Law. He had been teaching at New York University and doing research at the University of Munich and the Max Planck Institute before.

In comparison to other countries the tax burden on labor is relatively high in Austria. A high level of labor taxation has detrimental effects on employment. Alexander Rust wants to illustrate ways to shift taxation away from labor while keeping the overall tax revenue constant. Successful tax reforms in other countries led to a broadening of the tax base and a reduction of the tax rates. The taxation of the factor capital is still very beneficial in Austria. However, augmenting the tax burden on capital might have other harmful effects.

The Principle of Territoriality and the Cross-Border Loss Relief Problem for Companies in the EU

Inaugural Lecture from Prof. Traversa

Prof. Dr. Edoardo Traversa teaches International, European and domestic tax law at the Faculty of Law and Criminology of the Université Catholique de Louvain, where he currently serves as a Vice-dean for International relations.

His research mainly addresses the constitutional implications of the emergence of a common tax system in the European Union, the tax aspects of fiscal federalism in Belgium and in the EU, as well as specific issues in cross-border taxation of multinational companies in Europe (including VAT). He is also Of Counsel at Liedekerke law firm (Brussels).

He has been appointed visiting professor at the Institute for Austrian and International tax Law (WU) for the academic year 2013-2014.

![[Translate to English:] Ansicht Campus WU](/fileadmin/wu/_processed_/4/a/csm_112_campus_wu_laptop_960x310_d0ecfae120.jpg)