The Chinese Belt and Road Initiative: Opportunities and Risks from a European Perspective

The Chinese Belt and Road Initiative: Opportunities and Risks from a European Perspective

Panelists:

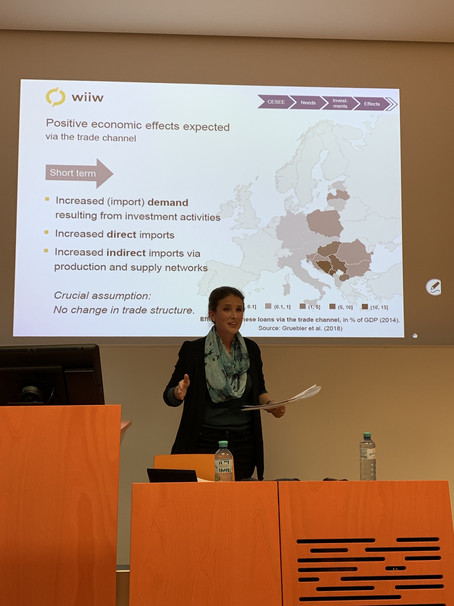

Julia Grübler (JG), Economist, Vienna Institute for International Economic Studies (wiiw)

Bernhard Ebner (BE), Business Unit Manager Intermodal, Rail Cargo Group

Clemens Machal (CM), Regional Manager Asia/Pacific, WKO

Moderator: Arnold Schuh, WU

The “Silk Road Economic Belt and 21st Century Maritime Silk Road” (or Belt and Road initiative in short) was launched by China’s President Xi Jinping in 2013. This initiative is an ambitious economic development program to improve regional cooperation and connectivity between Asia and Europe via economic corridors. 65 countries with 4.4 bn. inhabitants representing 30% of global GDP are located along the New Silk Road. The estimates of the envisioned funding volume range from $ 1-4 trillion – so far about $ 600 bn. have been spent for construction projects and foreign direct investment. The Chinese government promises a “win-win-situation” for all involved parties. It stresses the goals of policy coordination, facilities connectivity, unimpeded trade, financial integration and people-to-people bonds.

Europe is so far not among the top-destinations of BRI projects. But Europe is a core element in the BRI conception as it is the endpoint of several economic corridors, it is an attractive market with its more than 500 mio. inhabitants and European technology leaders, ports and logistics hubs are regarded as attractive targets for participation or takeover. The European “hotspots” are the Greek port of Piraeus and the “16(17)+1” Initiative in Central and Southeastern Europe (CESEE). The majority of EU member states has joined the BRI, recently even Italy what created quite a stir in the EU.

After the opening statements of the moderator and the invited panelists, the discussion at the podium and with the audience covered different aspects. Main answers of the panelists are presented in the following section.

Q: How is the need for infrastructure investment defined?

JG: The analysis is based on EBRD data. It is obvious that there is a huge infrastructure investment need in CESEE. To put the picture right: EU is the most important infrastructure financier in the Western Balkan and Southeastern Europe. Compared to the EU, China is strong in funding projects in the non-EU countries of the Western Balkans. And the EU is offering grants to the member states and partly to non-EU members. This happens in the context of the pre-accession instruments for the Western Balkan countries. Grants from the EU don’t carry any interest while for Chinese loans the receivers have to pay interest.

Q: What hinders China to sit down with the EU and coordinate the projects?

JG: There is a clear lack of coordination in improving the infrastructure in CESEE between the EU and China. Since last year, there have been finally some activities for a better coordination in those countries. In July, the EU-China Co-Investment Fund was created to support the poorest countries in Europe.

Q: What happens to countries that don’t sign the memorandum of understanding with China?

JG: Countries that did not sign a BRI MoU are not left out of the trade with China in the future. The MoU is only a political statement. There is nothing binding in it, no lists of agreements. It is only a message that these countries are willing to cooperate closely with China.

BE: Austria did not sign it and it has not affected us very much so far. We are approaching them in other ways, not under the BRI umbrella. The impressive Austrian delegation led by the president and including chancellor, ministers, diplomats and business executives last year was the biggest one Austria ever had. Every single project is finally always one between two companies, a Chinese and a European one.

Q: Is the EU not afraid of losing control over CESEE to China?

JG: The risk exists. The EU expects Western Balkan countries to apply its principles and rules already in the pre-accession phase. Besides, a majority of the European Commission is in favor of an EU membership of the Western Balkan countries.

Q: Are the acquisitions of stakes in European ports a pure coincidence or is there a plan behind it?

BE: China has a strong focus on everything related to transport and better connectivity. Starting from a small base, China created the 4th largest container shipping company, Cosco. Therefore, China needed a base in Europe and Cosco bought the concession in the port of Piraeus. Cosco uses the Piraeus port as a hub and entry point for CEE.

Q: How is the improved rail connection between China and Europe positioned between air and ocean freight?

BE: Rail connections below 14 days offer an attractive alternative for supply chains where speed counts, air cargo is too expensive and maritime cargo takes too long – more than 30 days. However, one should not forget that 95% of the container traffic between China and Europe happens still via ship. The Chinese government has a strong interest in modernizing the railway connections and supports the shipments of containers with subsidies – even the empty ones that return from Europe. While rail traffic is growing fast, it still counts not more than 2% of total traffic. Modern ships can carry up to 20,000 standard containers compared to about 80 on trains.

Q: Is the reciprocity in foreign direct investments given between the EU and China?

CM: China controls the FDI strictly – 3 of 4 direct investments by Chinese firms in the EU would not have been allowed in the other way. So far, Austria has not introduced any restrictions on Chinese direct investment here. Chinese firms invested in a few technology companies in Austria – exactly those investments would have be declined to Austrian firms in China.